san antonio tax rate 2021

Published on June 25 2019 by. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

The Top 10 Reasons To Move To San Antonio Tx Home Money

The San Antonio sales tax rate is.

. San Antonio collects the maximum legal local sales tax. The current total local sales tax rate in San Antonio TX is 8250. Did South Dakota v.

San Antonios fiscal 2021 tax rate of approximately 056 per 100 of TAV provides ample capacity below the statutory cap of 250. 48 rows San Antonio. City of San Antonio Print Mail Center Attn.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. City of San Antonio Attn. 211 South Flores Street San Antonio TX 78207 Phone.

However the Texas Legislature in 2019 approved and the governor signed into law Senate Bill SB 2 which made a number of changes to local governments property tax rate-setting process. San Antonio TX 78205. NOTICE ABOUT 2021 TAX RATES - City of San Antonio 8242021 with changes.

The latest sales tax rate for San Antonio TX. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. Rates will vary and will be posted upon arrival.

The citys revenues for 2022 is 21. The over-65 exemption is for property owners who are 65 years of age or older and claim their residence as their homestead. The County sales tax rate is.

Over the forecast period these revenues are expected to increase at an average annual rate of 30 with annual rates of change ranging from 32 in FY 2022 to 28 in FY 2026. San Antonio Tax Rate 2021. PersonDepartment 100 W.

Only property taxes levied on existing properties not new developments count toward the revenue growth calculation. Transit Sales and Use Tax rates. Mailing Address The Citys PO.

The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. The December 2020 total local sales tax rate was also 8250. Hours Monday - Friday 745 am - 430 pm.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. Jurors parking at the garage will receive a discounted rate please bring your parking ticket for validation at Jury Services. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The minimum combined 2022 sales tax rate for San Antonio Texas is. Jurors parking at the garage will receive a discounted rate please bring your parking ticket for validation at Jury Services.

The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. Jurors parking at the garage will receive a discounted rate please bring your parking ticket for validation at Jury Services. Monday - Friday 745 am - 430 pm Central Time.

The san antonio texas sales tax is 825 consisting of 625 texas state sales tax and 200 san antonio local sales taxesthe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. City Sales and Use Tax. There is no applicable county tax.

What is the sales tax rate in San Antonio Texas. Effective for tax year 2019 persons with a residence homestead are entitled to a 5000 exemption of the assessed valuation of their home. 2021 Adopted Budget and 32 or 395 million above the FY 2021 Estimate.

Greg Abbott signed the new law Senate Bill 2 in 2019 and it took effect in 2021 when the citys property tax revenues increased by 31. This exemption is a maximum of 65000 of taxable valuation. Box is strongly encouraged for all incoming mail.

1RWLFH ERXW 7D 5DWHV. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. The Texas sales tax rate is currently.

Rates will vary and will be posted upon arrival. PersonDepartment PO Box 839966 San Antonio TX 78283-3966. Road and Flood Control Fund.

This is the total of state county and city sales tax rates. FY 2021 Projection Reduction Community Visitor Facilities 544 424 120 a Visit San Antonio 249 162 87 Arts Culture 115 77 38 Hotel Occupancy Tax Fund Trial Budget a. Bexar County Texas Sales Tax Rate 2022 - Avalara Bexar County Texas sales tax rate Home Texas Bexar County Bexar County Tax jurisdiction breakdown for 2022 Texas 625 San Antonio 125 San Antonio Atd Transit 025 San Antonio Mta Transit 05 Minimum combined sales tax rate value 825.

2021 Official Tax Rates. 2021 low income housing tax creditchodo. 2021 antonio rate.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. To offset the Community Visitor Facilities Reduction in FY. 211 South Flores Street San Antonio TX 78207 Phone.

General Fund Forecast of Current Revenues in Millions FY 2021 Revenue Adopted FY 2021 Revised. 211 South Flores Street San Antonio TX 78207 Phone. Rates will vary and will be posted upon arrival.

Rates will vary and will be posted upon arrival.

Tax Rates Bexar County Tx Official Website

San Antonio New Braunfels 2022 Area Median Income Jumps To 83 500

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Homestead Exemptions Here S What You Qualify For In Bexar County

San Antonio New Braunfels 2022 Area Median Income Jumps To 83 500

San Antonio New Braunfels 2022 Area Median Income Jumps To 83 500

Tax Rates Bexar County Tx Official Website

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

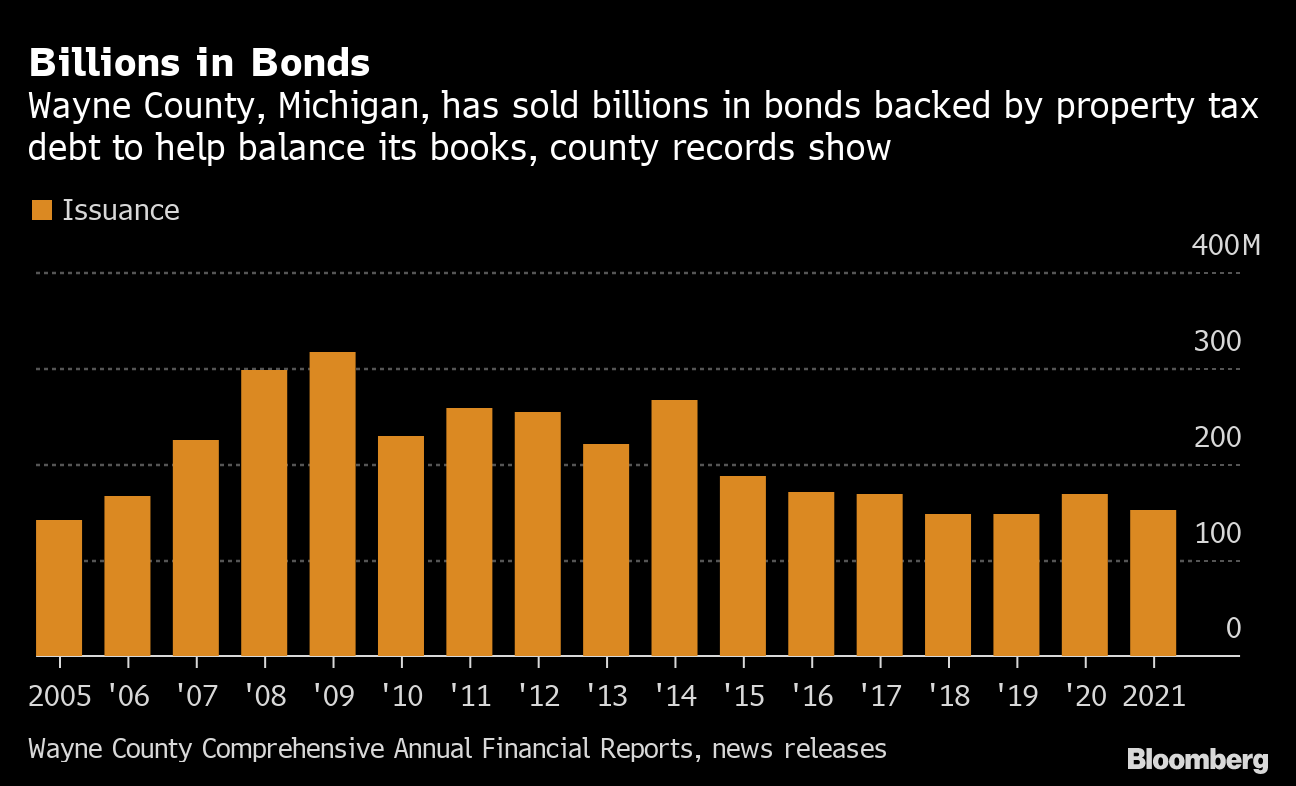

Property Tax Debt Scheme Minority Families Lose Homes To Money Machine Bloomberg

Billions Paid And Rising Plano Isd Could Cut Programs Due To Rising State Recapture Bill Community Impact

Annual Pass Benefits Seaworld San Diego

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Montgomery County Commissioners Propose 1 4 Property Tax Rate Decrease For Fy 2020 21 Community Impact

San Antonio New Braunfels 2022 Area Median Income Jumps To 83 500

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders